cash app card overdraft fee

You cant overdraw your Cash App Card on purpose. Every time you use your credit card to send money Cash App will charge you a 3 fee.

Cash App App How To Get Money Credit Card Info

A Better Way to Bank.

. You can have those fees waived if you receive a direct deposit of 300 or more into your Cash App account each month. Pays back overdraft fees if advance withdrawal puts your account in the negative. All qualifying members will be allowed to overdraw their account up to 20 on debit card purchases and cash withdrawals initially but may be later eligible for a higher limit of up.

Their Terms Of Service say that either the money has to be in their account or the user has to be connected to another account to fund the purchase. Cash App does charge a 2 ATM fee per withdrawal in addition to the fee the ATM provider charges. When you use your debit card or bank account to make a payment Cash App does not charge you any fees.

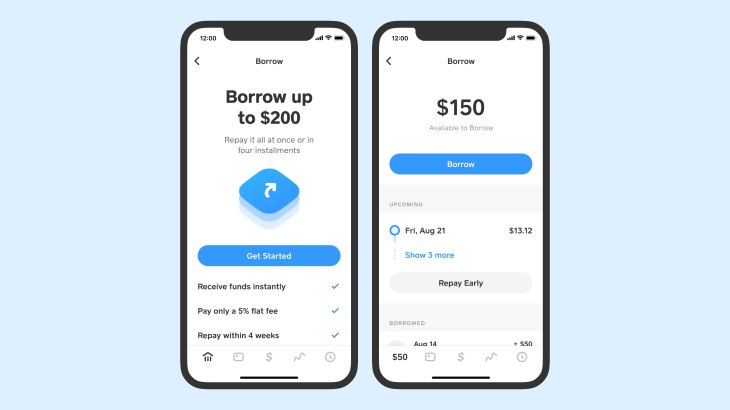

Current App borrow up to 200 in fee-free overdrafts. Removing the link EDIT There are cards that allow overdrafts in some form but CashApp is not one of them. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total.

Keep your money safe with security features overdraft up to 200 fee-free and get paid up to 2 days early with direct deposit with no hidden fees. Select an amount to add. With a Cash App instant transfer your money will be transferred instantly to your linked card¹.

Confirm the transaction either by using your Touch ID or PIN⁴. Heres when your Cash App will charge you a fee. Current is one of a growing number of fintech companies that offers all of the top features of a traditional bank straight from your phone often with no fees.

If you transfer someone 200 using the Cash App and your connected credit card youll be charged 206. Offer adding cash from a store or ATM. Tap the swirly line on the bottom right corner between the money and clock symbol.

Launch the Cash App. Hes definitely using that money for something shady. How To Borrow Money From Cash App Borrow.

Click the Banking tab on the Cash App home screen. You may be charged a fee by the ATM Operator. Any subsequent withdrawals in the 31 day period will be 200.

Chime is one of the best checking accounts weve reviewed and also offers up to 200 on debit card purchases with no overdraft fees. I think Bank of America BoA has monthly. Available using the Account.

With no overdraft facility Cash App does not charge overdraft fees. Chime is the banking app that has your back. Yes you can use a Cash App card to make withdrawals at different ATMs.

Does Cash App charge overdraft fees. Cash app can not overdraft if the expense is greater than your balance it declines. Launch the Cash App by touching the home screen.

If your account is negative you will have to deposit funds to clear your negative balance and be able to keep using Cash App to make purchases. Through the Cash App Taxes feature you can file your taxes for free and through Cash App Investing you can make investments and buy Bitcoin for as little as 1. The activity page on Cash App wont cut it.

You cant over draft on Cash App. The cash app works like any other debit card you can overdraft your bank account with it. How to go Into Overdraft With Cash App.

If you see the word Borrow you can apply for a Cash App loan. All you need is to. Tap on the Cash App balance in the lower left corner.

Tap the blue button with the arrow inside-similar to the Buy button to the right. Once you have received qualifying direct deposits totaling 300 or more Cash App will reimburse fees for 3 ATM withdrawals per 31 days and up to 7 in fees per withdrawal. I had 9 dollars in my account.

We currently do not offer overdraft or credit features. The company said its only testing the feature with around 1000 users for now. You will receive a QR code.

Please reach out to Cash Support if you have questions about your ATM fee. Note that youll incur a 2 fee as a withdrawal fee. Will be shown on the monthly generated bank statement for each account checking checking2 savings account credit card etc.

21 rows All Fees Amount. Tuesday I had a payment declined from Walmart even though I. There are no monthly fees or transaction fees on the Cash Card.

Open your Cash App. Instant transfer - 15. Look for the term borrow in the dictionary.

Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. Once youve topped up your Cash App balance youll be able to send directly from it to your friends as long as you have a verified account³. Prepaid cards with overdraft protection allow you to complete transactions that overdraw your account by as much as 10 with no penalty or fee as long as you restore sufficient funds in your account soon after the overdraft.

However there is a 50 cent fee charged for each person to whom you send money through the cash app so keep that in mind if you choose to use it as a means of creating an overdraft. A single overdraft fee can take between 15 and 25 from your account. Either the bank will reject it or they will allow you to over draft.

Tap on the Bitcoin tab next to the Stocks tab. Tap on the Cash App balance lower left corner Find the Borrow up to 200 option. So sending someone 100 will actually cost.

The Cash App instant transfer fee is 15 with a minimum of 025. These cash advance apps can help you out and are better than payday loans. Youll get a list of choices like deposit balance inquiry or cash withdrawal.

Insert your Cash App debit card and add your Cash Card PIN. Tap Scroll to Continue. You can also set up direct deposits to your account and get a debit card.

Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month. 1 Can Cash App be Used at an ATM. Read the user agreement.

The app enables you to send and receive money purchase stocks and Bitcoin. But it could become more broadly available and there are probably plenty of people who cou. This isnt entirely true.

Hey Cash App the peer-to-peer payments service from Square is giving select users a way to get short-term loans. It will just fail. Navigate to the Banking section.

Our top 3 recommended cash advance apps 1. Tap on Deposit Bitcoin.

Cash App Overdraft Understand When Cash App Balance Go Negative

How To Get Free Money On Cash App Gobankingrates

Why Does Cash App Have A Negative Balance Fix Cash App Negative Balance

Cash App Overdraft Understand When Cash App Balance Go Negative

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card

Cash App Overdraft Understand When Cash App Balance Go Negative

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Cash App Review 2022 Pros And Cons

Can You Overdraft Cash App Card Fix Cash App Negative Balance Frugal Living Coupons And Free Stuff

Can You Overdraft Cash App And How Much Would That Cost You

Can Cash App Balance Go Overdraft Negative Youtube

Learn About Cash App Overdraft Limit L Fix Cash App Negative Balance Cash App

Can You Overdraft Cash App All You Need To Know

Cash App Overdraft Can You Overdraw Your Cash App Card

Can You Overdraft Cash App And How Much Would That Cost You

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Cash App Overdraft Understand When Cash App Balance Go Negative

Why Does Cash App Have A Negative Balance Fix Cash App Negative Balance

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card